Table Of Content

It also allows the lender to take the house if you don’t repay the money you’ve borrowed. Let’s say you want to borrow $10,000 to update part of your home. The lender has offered a 5.99% interest rate on a three-year loan. With those terms, you’d need to pay back a little more than $300 per month. Mortgage refinance is the process of replacing your current mortgage with a new loan.

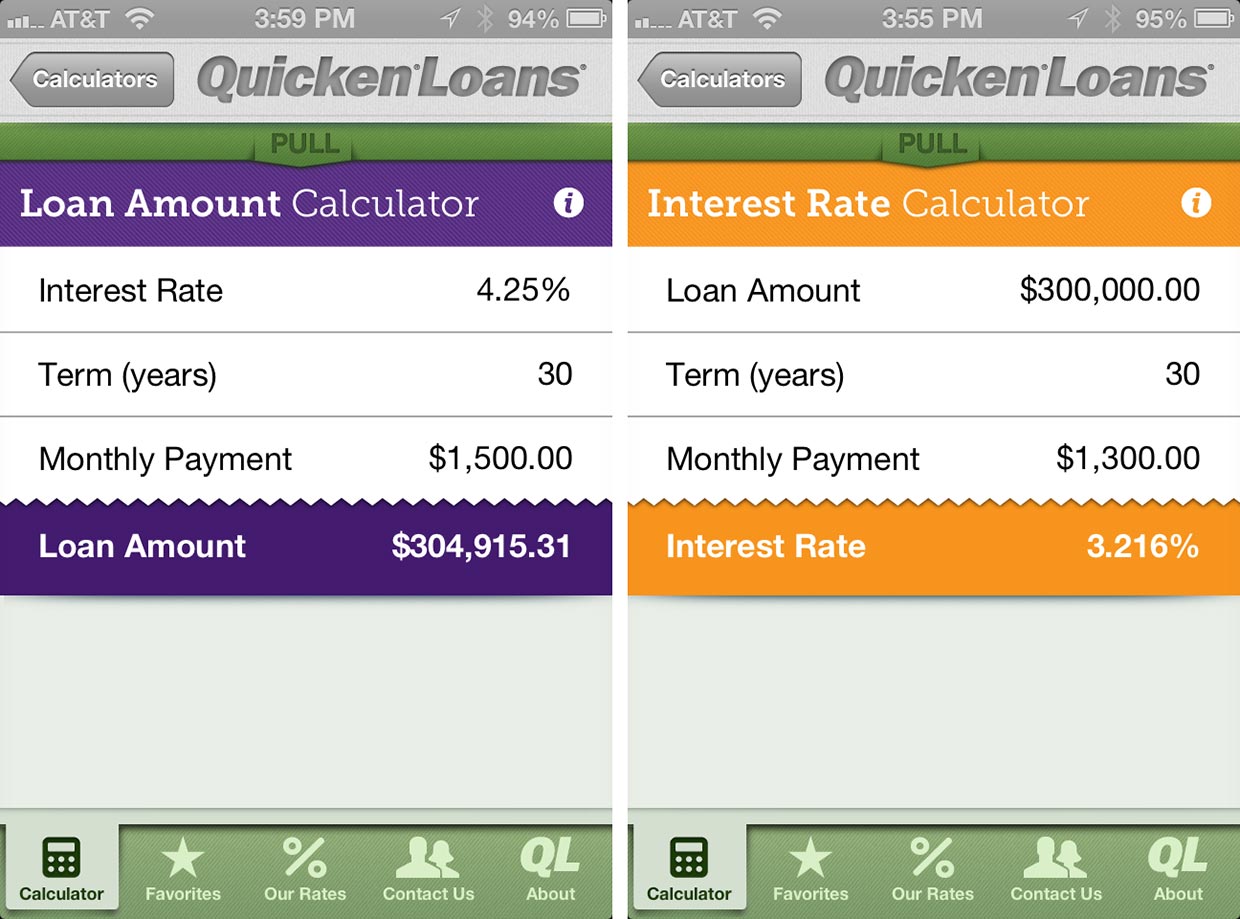

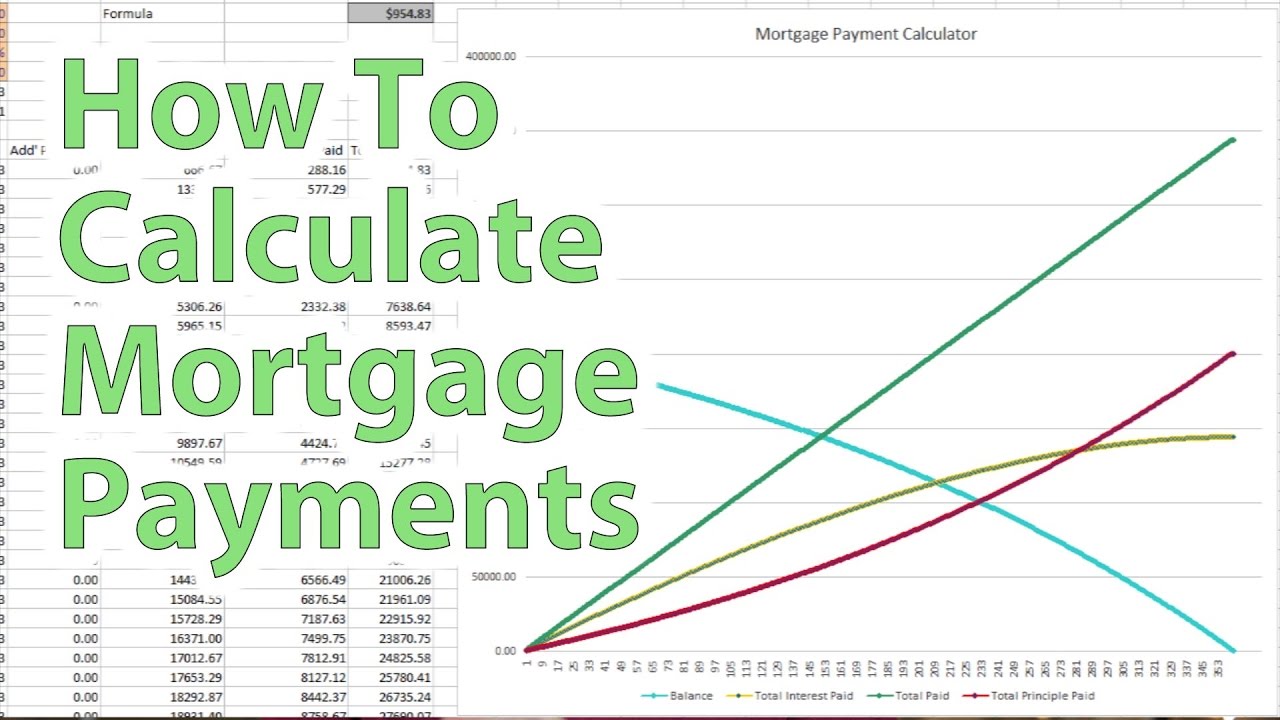

How to calculate your mortgage payments

The "principal" is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money. Additionally, some lenders have programs offering mortgages with down payments as low as 3% to 5%. The table below shows how the size of your down payment will affect your monthly mortgage payment. The mortgage calculator lets you click "Compare common loan types" to view a comparison of different loan terms.

How lenders decide how much you can afford

A 5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment. The first two options, as their name indicates, are fixed-rate loans.

Lock in Today's Mortgage Rates Right Now!

When all’s said and done, for a 30-year loan at 3.5% interest, we’ll pay $1,796.18 each month. Under "Home price," enter the price (if you're buying) or the current value (if you're refinancing). Escrow is a legal arrangement where a third party temporarily holds money on behalf of a buyer and seller in a real estate transaction. On desktop, under "Interest rate" (to the right), enter the rate. Under "Loan term," click the plus and minus signs to adjust the length of the mortgage in years.

North Carolina Mortgage Calculator - The Motley Fool

North Carolina Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

The monthly mortgage payment on a $300,000 house would likely be around $1,980 at current market rates. That estimate assumes a 6.9% interest rate and at least a 20% down payment, but your monthly payment will vary depending on your exact interest rate and down payment amount. A monthly payment calculator allows you to compare different scenarios and how they might affect your budget. Referring to the previous example, maybe $300 per month is too costly for you.

The longer the time horizon, the less you’ll pay per month, but the more you’ll shell out in interest over time. Shorter time horizons will require larger monthly payments, but you’ll pay less in interest over the life of your loan. Typically, when you belong to a homeowners association, the dues are billed directly, and it's not added to the monthly mortgage payment. Because HOA dues can be easy to forget, they're included in NerdWallet's mortgage calculator. The major part of your mortgage payment is the principal and the interest. The principal is the amount you borrowed, while the interest is the sum you pay the lender for borrowing it.

Down payment - The down payment is money you give to the home's seller. At least 20 percent down typically lets you avoid mortgage insurance. This formula can help you crunch the numbers to see how much house you can afford. Alternatively, you can use this mortgage calculator to help determine your budget.

Comparing common loan types

Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home. Estimate the cost of 30 year fixed and 15 year fixed mortgages.

To get the best mortgage interest rates and terms, you’ll want a down payment amounting to 20% of a home’s sale price. But if you don’t have 20%, you can put down as little as 3.5%, or in some cases 0%. Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio. Loan start date - Select the month, day and year when your mortgage payments will start. If Joe were to abide by the 28/36 rule, he’d spend no more than $1,400 on a mortgage payment each month.

Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage. If you don’t have an idea of what you’d qualify for, you can always put an estimated rate by using the current rate trends found on our site or on your lender’s mortgage page. Remember, your actual mortgage rate is based on a number of factors, including your credit score and debt-to-income ratio. In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage.

This type of insurance policy protects the lender’s collateral (your home) in case of fire or other damage-causing events. The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. If your mortgage pre-approval is set to expire before you’ve completed the home-buying process, this does not mean you have to start the pre-approval application process from square one.

Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the "Include Options Below" checkbox. There are also optional inputs within the calculator for annual percentage increases under "More Options." Using these can result in more accurate calculations. A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals.

To decide if you can afford a house payment, you should analyze your budget. Before committing to a mortgage loan, sit down with a year’s worth of bank statements and get a feel for how much you spend each month. This way, you can decide how large a mortgage payment has to be before it gets too hard to manage.

No comments:

Post a Comment